A Guide to Navigating the New Beneficial Ownership Information Reporting Requirements

***Important Update***

If you like drama, you can find it here! The Beneficial Ownership Information (BOI) filing pursuant to the Corporate Transparency Act has been quite the moving target. As of the date of this update (March 4, 2025), the Financial Crimes Enforcement Network (FinCen) has indicated that new rules (including extension of filing deadlines) will be released for the BOI filing by March 21, 2025 and no enforcement will be done in the meantime. But the Treasury Department has released information to indicate that even if new rules come out there will be no enforcement of those rules. Here is a high level summary of the background in case you are interested in the play by play:

- On Dec 3, 2024 a Texas District Court put in place a nationwide injunction on the requirement to file BOI reports, thus halting the requirement to file a BOI report.

- On Dec 23, 2024 a panel for the 5th Circuit (i.e. a subgroup of the 5th Circuit Court of Appeals) put a stay in place on the injunction, thus putting the BOI filing requirement back in place (and FinCen then said that the filings that were originally due Jan 1, 2025 will be pushed back to Jan 13, 2025).

- On Dec 26, 2024 the full 5th Circuit vacated the stay, thus putting the injunction back in place, meaning that, again, no filing is required.

- On Jan 7, 2025 a Texas District Court imposed another nationwide ban on the filing.

- On Jan 23, 2025 the US Supreme Court lifted the nationwide ban on the filings pertaining to one case, but FinCen confirmed that filing remained voluntary due to another case.

- On Feb 17, 2025 a Texas Court granted a stay re the Jan 7 injunction meaning that the CTA was back in effect.

- On Feb 18, 2025 FinCen issued guidance announcing that the BOI filing requirements were back in effect with a March 21, 2025 deadline for most entities.

- On Feb 27, 2025 FinCen issued guidance saying that new rules would be issued by March 21, 2025 and that those new rules will include an extension of the filing deadline. The guidance also stated that no fines, penalties, or enforcement of any kind will occur in the meantime.

- On March 2, 2025 the Treasury Department announced that it will not enforce any penalties or fines of any kind under existing rules, nor will it enforce any forthcoming rule changes.

It is possible that the filing requirement, and enforcement of such requirements, will again become effective so companies may want to continue to prepare for the filing if they have not already completed the filing. However, as of the date of this update, no enforcement of the BOI filings is occuring. Please note that the information below was published prior to this important update, and further developments regarding the BOI filing requirement and the CTA may be possible after this update.

For startup founders, the Corporate Transparency Act (CTA) brings about new federal reporting requirements. Effective January 1, 2024, this act primarily addresses money laundering and terrorism financing concerns, but its new reporting requirements on information about beneficial owners will affect many in the startup ecosystem. Please note that this post was drafted in the fall of 2023 and the requirements described below may be subject to change.

Do the New Reporting Requirements Apply to My Company?

If you've founded a company or plan to, it's crucial to determine if it qualifies as a "reporting company.” In general, if either (1) you registered your company by filing with a Secretary of State (e.g., corporation, LLC), or (2) if you're a foreign entity registered in the U.S., you'll need to file a report with FinCen.

While most companies will be required to comply with the beneficial ownership reporting requirement, there are 23 types of entities that are exempt, including publicly traded companies, certain financial institutions, governmental entities, and others. Some potentially relevant exemptions for companies include:

- Exemption #6 (Money Transmitting Business): Registered money transmitting businesses with FinCen may not need to report. Examples could include companies on digital or cryptocurrency platforms.

- Exemption #20 (Entity Assisting a Tax-exempt Entity): Companies that exclusively assist or govern tax-exempt entities, are U.S. persons as defined in section 7701(a)(3) of the Internal Revenue Code, and fulfill other criteria related to U.S Citizenship or permanent residence.

- Exemption #21 (Large Operational Entities): Entities with significant operations and a strong presence in the U.S. may be exempt. This includes entities employing over 20 full-time employees in the U.S., maintaining an active physical office within the U.S., and demonstrating substantial economic activity with over $5,000,000 in gross receipts or sales reported on specific U.S. tax forms. Additionally, this amount must still exceed $5,000,000 after excluding income from sources outside the U.S.

- Exemption #23 (Inactive Entity): If your company (1) was in existence on or before January 1, 2020, (2) is not engaged in active business, (3) is not owned, wholly or partially, directly or indirectly, by a foreign person, (4) has had no change in ownership in the past year, (5) has not sent or received funds greater than $1,000 in the past, and (6) does not hold any assets, including ownership interests in other entities, in the United States or abroad.

If your company qualifies as a reporting company, you must also identify at least one, and a maximum of two, individuals (not companies or legal entities) who will serve as the company applicant(s). There are two categories of company applicants: (1) the “direct filer” and (2) the individual who “directs or controls the filing action”.

When and Where Does My Startup Need to File the Report?

Reporting companies have different dates for the initial filing depending on when the company was formed.

- For companies formed or registered before January 1, 2024, you must report by January 1, 2025.

- For companies formed or registered between January 1, 2024 through December 31, 2024, you must report within 90 days of formation or registration.

- For companies formed or registered in 2025 and beyond, you must report within 30 days of formation or registration.

You’ll need to report beneficial ownership information electronically through FinCEN’s website.

What if My Startup has a Change in Beneficial Ownership?

If your startup undergoes a change in ownership structure, such as a new CEO being appointed or a significant sale impacting ownership thresholds, specific filing obligations come into play:

- An updated Beneficial Ownership Information (BOI) report is not required solely for changes in the type of ownership interest a beneficial owner holds in a reporting company (e.g., conversion of preferred shares to common stock), as FinCEN does not mandate reporting on the type of interest.

- However, if there is any alteration to the required information about the reporting company or its beneficial owners as previously filed in a BOI report, the reporting company must submit an updated BOI report within 30 days of the change occurring. This 30-day timeframe also applies to amendments in information provided by individuals to obtain a FinCEN identifier. Changes necessitating an updated BOI report include alterations in reported information about the reporting company itself, such as registering a new DBA, or changes in beneficial owners, such as appointing a new Chief Executive Officer, a sale affecting the ownership threshold of 25 percent, or the demise of a beneficial owner.

What is the Consequence of Not Filing or Providing Incomplete Reports?

Intentionally false or incomplete reports can lead to a $500 daily civil penalty (up to $10,000) and up to two years of imprisonment. Remember: your company must make a correction no later than 30 days after the date it became aware of an inaccuracy or had reason to know of it.

What is Included in the Report and Who is Considered a “Beneficial Owner”?

The report must detail:

- Information about the company, including its legal name (as well as any trade names and DBA names), U.S. address, jurisdiction of formation (state, tribal, or foreign), tax IDs (including IRS Taxpayer and Employer Identification Numbers), and for a foreign reporting company, the state or tribal jurisdiction of first registration.

- Information about the “beneficial owners” of the company, including legal name, date of birth, current address (U.S. or foreign). This information must be reported for each beneficial owner in the case that there is more than one.

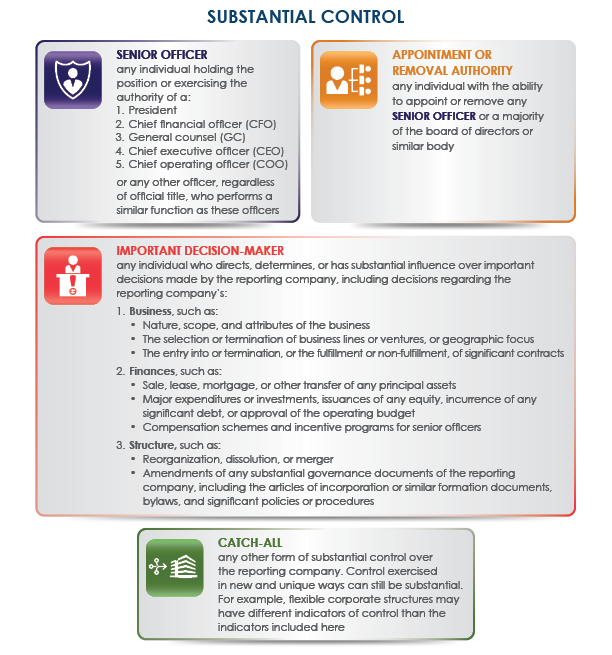

A "beneficial owner" is someone who either directly or indirectly (1) owns or controls at least 25% of the reporting company’s ownership interests, which includes, but is not limited to equity, stock or voting rights; a capital or profit interests convertible instruments; and/or options, or (2) exercises substantial control over the reporting company. Substantial control is determined on a case-by-case basis, however, for most companies it will include executive or senior officers, directors, stockholders that have the authority to appoint or remove directors, and investors that hold significant decision-making authority in the company. FinCEN also includes a catch-all provision for determining substantial control. For more information generally on how substantial control is determined, FinCEN also provides this chart:

There are generally 5 exceptions to the definition of beneficial owner, including for example, minor children. Most of the exceptions will not likely apply to startup companies, however, it is worth noting that “certain employees” are not considered beneficial owners if they meet all of the following conditions: (1) They are employees[1] subject to the company's control and can be terminated, (2) their control or economic interest in the company is solely due to their employment (i.e., not a controlling stockholder or equity holder), and (3) this control or interest does not extend beyond their employment status. This exception acknowledges that an employee’s authority within a company can be significant without equating to beneficial ownership. For example, such an employee could be a manager who holds sway over daily operations and has a performance-based bonus structure but does not have equity in the company or the power to influence the board of directors or corporate policies. For the most part, startup founders and many investors will likely qualify as beneficial owners.

Additionally, if your company files a report, but then later qualifies for an exemption, you may file an updated report that indicates that the company is newly exempt from reporting requirements.

Who Can View My Data?

While the data you submit will be stored securely by FinCEN, it isn't entirely inaccessible. Federal, state, local, and certain tribal entities can view it under specific conditions. This isn't public data and won't be available via Freedom of Information Act requests. However, rules on report protection and confidentiality are still being refined by FinCEN.

Preparing Your Startup for Compliance

Here's what founders and startup executives should be gearing up for:

- Immediate reporting upon company formation if you're starting after January 1, 2024;

- Creating a compliance strategy that can evolve with your company's growth;

- Delegating compliance responsibilities to a designated team member who can collaborate with your legal team to ensure filings are completed accurately and on time; and

- Adapting company documents to ensure they align with compliance needs.

All businesses, even those exempt from the reporting requirements, should have a game plan in place. Incorporating compliance clauses in governing documents will also become commonplace, especially in transactions with banks and institutional investors.

Additionally, for more information, FinCEN has issued the following guidance materials:

- Updated “frequently asked questions” (FAQs) include new questions about beneficial owners, initial reports, FinCEN identifiers, and third-party service providers.

- Small Entity Compliance Guide translations.

- BOI brochure.

- FinCEN BOI webpage.

[1] This include employees under the common law standard as defined under 26 CFR 54.4980H-1(a)(15), and excludes leased employees, sole proprietors, partners of a partnership, 2-percent S-corporation shareholder, and certain real estate agents and other direct sellers.

This blog post was written by Sanam Analouei, Ryan Shaening Pokrasso, and Becky Mancero.

Categories

Recent Posts

- Scaling Social Impact Startups: Protect Your Mission

- Five Data Privacy Questions For Businesses to Consider In 2026

- SPZ Legal Advises Fern in Its Acquisition by Rain

- SPZ Legal Advises Striga in Lightspark Acquisition

- Startup & VC Attorney Paige Southworth Joins SPZ Legal

- Startup Funding: Selling Shares to Raise Funds

- Program-Related Investments (PRIs) for Startups

- Sam Taylor & Becky Mancero Best Lawyers: Ones to Watch®