A Guide To Equity Compensation For Startups

Incentivizing employees, advisors, and contractors with equity is a game-changer for startups because it helps gets everyone on the same page when it comes to the company's success. When you give your team a piece of the pie, they’re not just clocking in and out—they're genuinely invested in the growth and potential upside of the business.

This kind of equity compensation is a fantastic way to attract and keep top talent, build loyalty, and encourage a long-term commitment. Plus, it gives everyone a shot at reaping the financial rewards when the company does well, creating that all-important sense of ownership.

This article offers a high level guide on equity compensation for startups, outlining critical differences between stock options and restricted stock, as well as alternative tools, and discussing administrative considerations and tax implications related to each.

Table Of Contents

- Stock Options vs Restricted Stock

- NSOs vs ISOs for Startups

- Synthetic Equity (Non-stock options)

- What Not To Use for Compensation: SAFEs, Notes, and Warrants

- Founder Equity Split: Rebalancing Cap Tables

Key Points You’ll Learn About:

- Differentiation between stock options and restricted stock, presenting their unique considerations and uses.

- Significant tax implications that vary depending on the type of stock option chosen (NSO vs ISO).

- Special considerations for significant shareholders, particularly concerning extended exercise periods and the option for early exercise.

- Synthetic equity structures as alternatives to traditional stock compensation.

- Why instruments like SAFEs, convertible notes, and warrants are unsuitable for compensation amidst startup equity strategies.

- The need for a balanced approach in structuring equity stake arrangements and rebalancing cap tables, especially in scenarios involving departing founders.

Let’s dive in.

Stock Options vs Restricted Stock

Most startups look at two main types of equity: stock options and restricted stock. These vehicles are indeed the most commonly used tools for equity compensation. Each has its perks and quirks, and understanding the differences can help you make the best choice for your team. Just remember, before you start handing out stock, it’s crucial to set up an Equity Incentive Plan to keep things organized and compliant.

Most startups look at two main types of equity: stock options and restricted stock. These vehicles are indeed the most commonly used tools for equity compensation. Each has its perks and quirks, and understanding the differences can help you make the best choice for your team. Just remember, before you start handing out stock, it’s crucial to set up an Equity Incentive Plan to keep things organized and compliant.

Stock Options

With stock options, the recipient gets the chance to buy shares in the future at a price that is set based on current fair market value at the time that the option is granted. Although this can vary, usually the option becomes exercisable as it vests (with the most common vesting schedule being a four-year vesting period with a one-year cliff). This means the recipient does not have to shell out any cash upfront. Instead, the recipient can wait until the option vests and then decide if they want to buy in. Stock options are often used after the company has raised investment and, thus, the fair market value has increased.

Setting up stock options can seem a bit daunting at first, but it’s pretty standardized these days. Platforms like Carta and Pulley really streamline that ongoing management by minimizing paperwork on the front end when an employee is granted an option as well as on the back end when employment ends. In general, once the initial hump of setting up a system for stock options is done, it is less administrative and legal work to use stock options.

Restricted Stock

Restricted stock grants give the recipient immediate ownership of stock but, of course, the recipient must pay fair market value for that stock at the time of grant (or potentially significant tax implications come into play). Restricted stock can also be subject to vesting (and typically is) but in this context, vesting refers to the right to keep stock in the event that the individual leaves the company (and any unvested stock is subject to claw back by the company). Because restricted stock requires payment out the gate, it is often used prior to the company having a meaningful fair market value (often before significant fundraising has occurred).

If you’re looking at restricted stock instead of stock options, prepare for a bit more administrative complexity and legal costs. You’ve got to keep track of those crucial 83(b) elections (which almost always help recipients and the company avoid significant tax liability as vesting occurs over time) , plus deal with the logistics of repurchasing stock when someone leaves.

And let’s not forget the tax implications. If a recipient holds stock for over a year, then typically lower capital gains tax rates will apply. But remember, for stock options, the clock doesn’t start ticking until the recipient actually exercises the option to purchase stock. Similarly, if the company is a Qualified Small Business, the recipient could enjoy very significant tax benefits upon the sale of the company if the stock is held for five years (starting from the date of grant for restricted stock and the date of exercise for options).

NSO vs ISO Stock Options for Startups

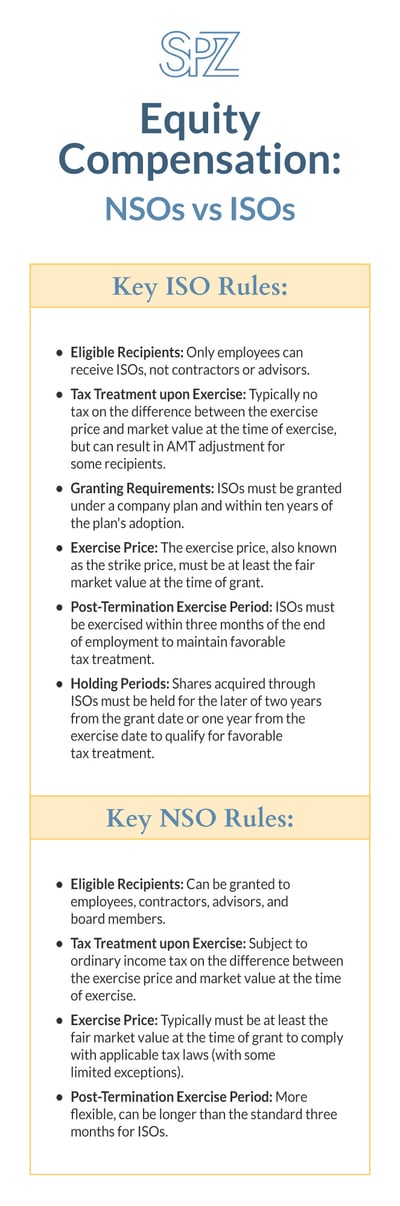

Assuming your company determines that stock options are the avenue to pursue, there are two types of stock options: Non-Qualified Stock Options (NSOs) and Incentive Stock Options (ISOs). Understanding the tax differences between NSOs and ISOs is crucial for companies and employees.

Assuming your company determines that stock options are the avenue to pursue, there are two types of stock options: Non-Qualified Stock Options (NSOs) and Incentive Stock Options (ISOs). Understanding the tax differences between NSOs and ISOs is crucial for companies and employees.

ISOs typically offer better tax benefits for employees since they are taxed more favorably. Exercising NSOs results in ordinary income tax to the recipient on the spread between the exercise price and the fair market value of the stock at the time of exercise (and if the recipient is an employee, then there would be a corresponding withholding obligation for the company).

By contrast, exercising ISOs usually doesn’t incur immediate taxes, though it may affect alternative minimum tax (AMT) if the recipient is subject to AMT. For this important tax reason, most startups issuing stock options use ISOs for employees and NSOs for contractors and advisors.

However, ISOs have strict rules. Among others, they’re only for employees of a C-Corp (and its subsidiaries), must be granted under a formal plan, and need to be exercised within three months of leaving.

Significant shareholders (10% or more) must be aware of key rules concerning ISOs. The exercise price must be at least 110% of fair market value, and options need to be exercised within five years. Additionally, only the first $100,000 of exercisable ISOs in a calendar year retains ISO status; excess is treated as NSOs. This can complicate matters if the company's value increases or if early exercise is permitted.

While most startups offer a typical three-month exercise window post-departure, some extend it, but doing so can impact the classification as ISOs so should be done thoughtfully.

Allowing early exercise of stock options can provide favorable tax treatment but also involves more administrative and legal complexity akin to the work involved in granting restricted stock. If immediate exercise is desired, companies may prefer restricted stock over options.

It's crucial to consult legal experts to navigate these complexities and develop appropriate compensation plans for your startup.

Synthetic Equity: Non-stock Compensation Alternatives

While restricted stock and stock options are the usual go-tos for giving startup team members a piece of the pie, sometimes “synthetic equity” can be a smart alternative. This type of compensation feels a lot like real equity but some of the rules differ. At a high level, synthetic equity typically refers to a structure where service providers are entitled to a payment (but, importantly, taxed as ordinary income) in an amount that mimics what the person would have received had they held actual stock in the company.

While restricted stock and stock options are the usual go-tos for giving startup team members a piece of the pie, sometimes “synthetic equity” can be a smart alternative. This type of compensation feels a lot like real equity but some of the rules differ. At a high level, synthetic equity typically refers to a structure where service providers are entitled to a payment (but, importantly, taxed as ordinary income) in an amount that mimics what the person would have received had they held actual stock in the company.

Synthetic equity can be helpful in many circumstances, but especially when (a) a company's fair market value has shot up, making it tough to offer traditional equity at a lower price; (b) a company missed the chance to give out equity when values were lower and synthetic equity can help make things right without further diluting ownership; and (c) startups want to keep their cap table tidy with fewer holders; or (d) a company is not set up as a C-Corp.

Synthetic equity is a great way for companies to reward employees without giving them actual stock. Triggers for payment under synthetic equity structures can vary but is often tied to an acquisition of the company.

While there are many varieties, phantom stock, stock appreciation rights (SARs), and creative bonuses are three common approaches. Phantom stock typically pays out based on the value of shares as if you owned them, but it’s taxed as ordinary income, not capital gains. SARs work similarly, letting you cash in on the increase in stock value, also taxed as ordinary income. Creative bonuses are super flexible and can be tied to company goals or performance, making them a great way to motivate employees. Just remember, companies need to be careful with complex deferred compensation tax rules under IRC §409A to avoid hefty penalties!

SAFEs, Notes & Warrants: Not for Compensation

When a startup is looking to pay someone for their services without going the traditional route of cash or stock grants, they might consider alternatives like SAFEs, Convertible Notes, or Warrants. While this may be tempting, these tools are really used for investment and should not be used for compensation of service providers.

When a startup is looking to pay someone for their services without going the traditional route of cash or stock grants, they might consider alternatives like SAFEs, Convertible Notes, or Warrants. While this may be tempting, these tools are really used for investment and should not be used for compensation of service providers.

For example, a vendor could be offered a SAFE instead of cash for their monthly services, but the value of that SAFE would be taxable as ordinary income. Similarly, if a company delays issuing stock options to employees, they might think about giving out SAFEs to balance things out, but that also opens up a whole can of tax worms. Plus, there are investor restrictions and IRS rules to consider, making it tricky. So, while creative compensation ideas such as these sound great in theory, they often end up being more hassle than they’re worth and it is best to focus on using more traditional investment vehicles.

Founder Equity Split: Rebalancing Cap Tables

Sometimes the original equity split at the time of incorporation no longer makes sense after the company has been making strides. In these cases, it becomes necessary to rebalance the cap table to maintain fairness and motivation among founders as their contributions and responsibilities evolve over time. To rebalance the cap table in the most compliant and tax efficient way, founders should follow a structured process.

Sometimes the original equity split at the time of incorporation no longer makes sense after the company has been making strides. In these cases, it becomes necessary to rebalance the cap table to maintain fairness and motivation among founders as their contributions and responsibilities evolve over time. To rebalance the cap table in the most compliant and tax efficient way, founders should follow a structured process.

For instance, in a scenario where one founder has reduced their commitment and another is significantly contributing, the underperforming founder could surrender shares to a targeted amount. The company would then directly issue new shares to the contributing founders, ensuring compliance with Fair Market Value (FMV) regulations and maintaining the possibility for the new shares to be Qualified Small Business Stock (QSBS). This is often the more tax efficient approach as opposed to just transferring shares from one founder to another. But there are nuances to this process that need to be taken into account.

Equity compensation, with all of its nuances and potential pitfalls, is something most startups need legal support for. It’s important to weigh all considerations so that fair, equitable, and financially smart strategies are put into place.

For personalized and experienced support in structuring equity compensation for your startup, contact us today.

Categories

Recent Posts

- Scaling Social Impact Startups: Protect Your Mission

- Five Data Privacy Questions For Businesses to Consider In 2026

- SPZ Legal Advises Fern in Its Acquisition by Rain

- SPZ Legal Advises Striga in Lightspark Acquisition

- Startup & VC Attorney Paige Southworth Joins SPZ Legal

- Startup Funding: Selling Shares to Raise Funds

- Program-Related Investments (PRIs) for Startups

- Sam Taylor & Becky Mancero Best Lawyers: Ones to Watch®